Corporate Wellbeing

We support corporate HR or Benefits team specialists

City Capital Financial Planning core business model is working with HR and Benefit teams to offer an onsite Financial Planning advice service to employees. Never before have the services of a truly Independent Financial Planning advisory business been more relevant and useful..

Our aim is to enhance your communications of your benefits package so that the employee fully understands what they have in place and to also help them make suitable financial decisions on their future planning.

Enhance the communications of your benefits

Pension legislation has become more complex and constant tax efficiencies are being changed within annual Government budget announcements. This is leading to our services being perceived as a great voluntary benefit for companies to provide for their staff and we are finding that our services are becoming a key component of the focus on promoting ‘financial awareness and well-being’ amongst employees.

We work with professional firms and our services are always tailored to the requirements and ethos of the company. Our partners are from a broad spectrum of industries including Investment Banking, Consultancy and Law firms.

Most IFA’s, City Capital Financial Planning included, usually charge clients either a standard rate fee (From £500 upwards) to initially engage with a retail client. However, as a concession to our corporate partners, we offer a completely fee-free service for the initial 45-minute meeting with the employee. We do not charge the employer or the employee for this initial discussion.

In 2017, we met with over 1,000 clients within employee advice service schemes. From these meetings, we received over 200 positive feedback responses. We have helped corporate employees with a variety of financial planning issues from life insurance through to far more complex pension transfer advice and even Inheritance Tax planning advice for their families.

Corporate Financial Planning Services

We tailor our service to suit the ethos and objectives of the company that we are working with. Historically, this has included: –

- Quarterly or Monthly ‘Surgeries’ – providing one to one advice meetings in the client’s office, and telephone or video conferencing meetings if suitable.

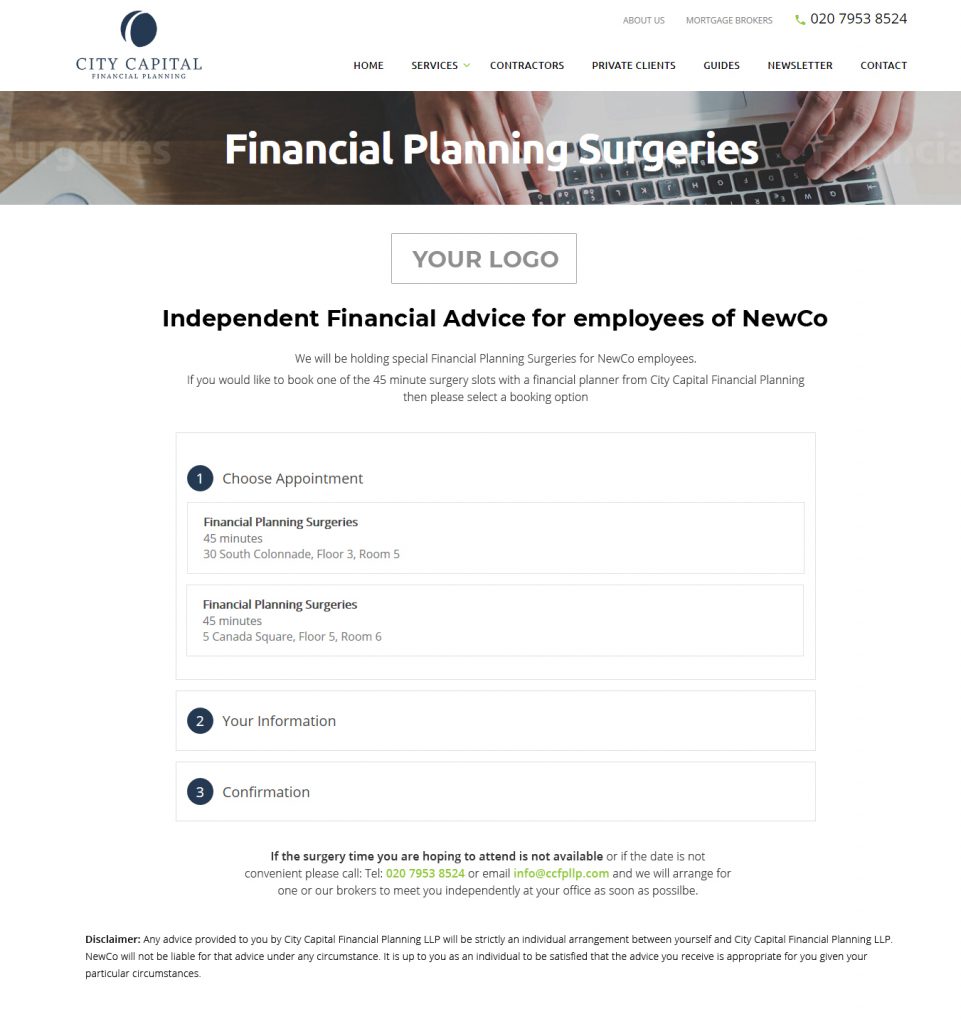

- A dedicated and co-branded appointment booking and Financial Planning information website.

- Presentation sessions – On a variety of subjects including Pensions, investments, Inheritance Tax planning and Trusts and offshore investment planning.

- Provider Fair attendance – if applicable.

- Graduate Entry/New starters – Financial Planning Seminars and more general ‘hints and tips regarding financial education, particularly aimed at ‘new starters’.

- Each client is then allocated to a dedicated adviser for all future advice and support and has an additional support contact working with each adviser once advice is transacted.

We also realise that in a digital world, clients like choice and instant information 24/7. Therefore, we are also offering telephone and online video advice as well. More details will follow.

Dedicated Booking Website

We provide each partner company with a bespoke website featuring general financial planning information and a appointment booking functionality to ensure all enquiries come directly to us and the service does not generate any additional workload for HR.

Services

Quick links

Information

Contacts

Suite 3.20, 3rd Floor

1-2 Paris Gardens

Southwark

London SE1 8ND